There are many definitions of risk, so many in fact as proposed by many Organizations, that their multiplicity clearly indicates that it's not a physical but perceptual/perspectival entity or notion. For example, the notion if risk is implicit in this nice explanation of the role of insurance:

There are many definitions of risk, so many in fact as proposed by many Organizations, that their multiplicity clearly indicates that it's not a physical but perceptual/perspectival entity or notion. For example, the notion if risk is implicit in this nice explanation of the role of insurance:"the function of insurance is not to protect the community from loss, but to provide a means by which the individual who is exposed to the risk of possible loss may ensure that, if the loss does occur, it will be shared by others. In return, he must contribute to the losses suffered by others" Esler and Parkes, 1970Epictetus devoted considerable energy (in the form of aphorisms) to understand how people decide their behavior, or their mood for the most part, based on the perceptions we assign to hypothetical, not-yet-occurred events. From a psychological expressed in form of proverbs Epictetus gave the three components of risk that are today widely accepted:

Men are disturbed, not by things, but by the principles and notions which they form concerning things (Ench. V) - Perturbant homines non res ipsae, sed de rebus decreta,We see here

- things: the event that could happen

- principles and notions (opinions): the objective probability assigned to the occurrence of such event.

- (they) form: the vulnerability assessment that given the (likely) event happening, the outcome would not be positive. This component is realistic, e.g. if a horse kicks me, there'll be a lot of damage.

- disturbance: the risk assessment which encompasses all the previous three elements: the event, the subjective likelihood that the event will happen, and the damage it might cause.

This concept has been a psychological feature since always. However, in the 17th century, Pascal expressed it in mathematical terms. He also resorted to an example in a chapter of La Logique ou L'Art de Penser, also known as Ars Cogitandi, published in Paris in 1662. Pascal formulated that it wasn't reasonable to be excessively terrified to die when one hears a thunder because:

Fear of harm ought to be proportional not merely to the magnitude of the harm, but also to the probability of the event. (La Logique, IV, XIII)

.jpg) |

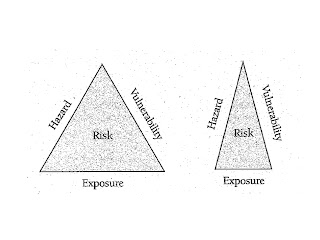

| The Risk Triangle. From Crichton (1999) |

This quote conveys the three components of risk, a) risk or probable loss (fear of harm) which has to be estimated, b) vulnerability (magnitude of the harm), and c) the probability of hazard (probability of the event).

In the field of catastrophe insurance, David Crichton came up with a useful graphical conceptualization of risk by means of what he called "The Risk Triangle".

In catastrophe modeling, risk has three components, Natural Hazard (hurricane, earthquake, hail, snowstorms, etc.), the exposure of the population-at-risk, and the Vulnerability of the building stock. Crichton explains that if either of the three decreases, then the overall risk decreases, or viceversa.

Crichton, D. (1999), The Risk Triangle. Risk Management, 102-103.

Esler and Parkes (1970), Introduction to the Insurance in Australia and New Zealand. West Publishing. Sydney.

No comments:

Post a Comment